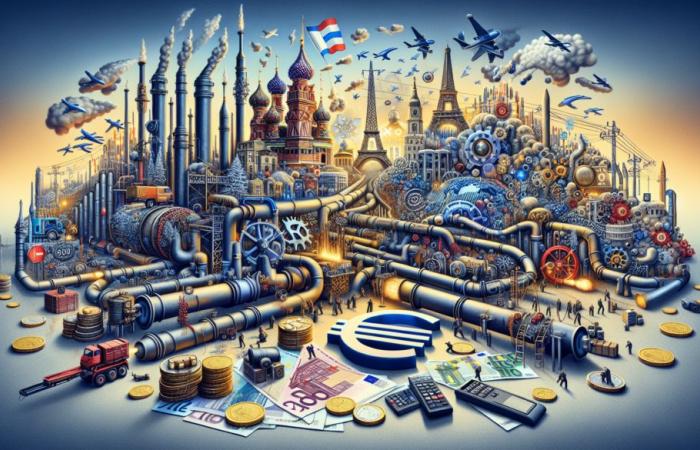

For several days, Europe has been facing a shock in its gas market following an arbitration which favored the Austrian company OMV against the Russian giant Gazprom. As the Old Continent continues to diversify its sources of supply, this affair raises questions about the impact on Russian gas flows, particularly for Eastern European countries. The market reaction is immediate, with a surge in contracted gas prices in the short term.

OMV against Gazprom: an arbitration that is making waves

The conflict between OMV and Gazprom was brought before an arbitration court, which ruled in favor of the Austrian company, thus authorizing OMV to claim almost 230 million euros in compensation for non-compliant gas deliveries. This decision led OMV to no longer settle cash calls relating to delivered gas, which prompted Gazprom to cease its deliveries to Austria from November 16, 2024. An amount of 17 million cubic meters of gas per day , which represented around 7 TWh per month, will therefore be absent from the Austrian network, driving up prices on European markets.

In response to this situation, short-term contracts (Day-Ahead, December 2024) showed a significant increase in prices. According to sector specialists, this rise in costs is explained by the market's sensitivity to supply disruptions, even if Russian flows via Ukraine remain intact, at 42 million cubic meters per day.

The consequences for Eastern Europe

Eastern European countries face a difficult equation, combining dependence on Russian gas and pressure to diversify their supplies. Slovakia, for example, illustrates these challenges. Currently, the country remains largely dependent on Russian gas, despite a potential supply of liquefied natural gas (LNG) imported from Germany. However, high transit costs make this option unattractive, leading some countries to prefer cheaper Russian gas.

Neighboring countries, such as Hungary and the Czech Republic, quickly seized the opportunity to compensate for the lack of flows to Austria. This situation highlights the complexity of energy diversification in a region where infrastructure and costs remain problematic. Note that the Russian-Ukrainian gas transit agreement expires on December 31, 2024, and many are wondering about its renewal.

France: reduced dependence but room for maneuver internationally

On the French side, the energy landscape has evolved. France is no longer dependent on Russian gas delivered by pipeline, replacing that source with imports from Norway, Algeria and other countries such as Qatar and Nigeria. This strategic change allowed it to diversify its supplies, in particular thanks to the multiplication of LNG terminals on its territory.

However, this diversification comes at a cost. By turning to the international market, particularly Asian prices, France may have to face greater price fluctuations. The terminals of Montoir, Fos Cavaou, Dunkerque and more recently Le Havre, facilitate the import of LNG, but also expose France to the volatility of the world market.

As Europe navigates these energy tensions, the decisions made by each country will impact their long-term security of supply and energy costs. The road to sustainable energy sovereignty remains strewn with pitfalls.

“`