• In October, the Banque de France survey in industry progressed slightly (+1 pt to 95), while it was stable in services (unchanged at 94) and in construction (unchanged at 93). The Banque de France forecasts that activity would be stable on 4e quarter, after +0.4% in 3e quarter. This stability would result from the increase in GDP excluding the Olympic Games, or underlying, at +0.2%, from which the mainly accounting impact of the Olympic and Paralympic Games (JOP) of around −0.2 must be subtracted. %.

• The monthly change in the consumer price index for October is +0.3%, revised upwards by 0.1 point; its annual evolution is confirmed at +1.2%.

Focus on inflation and the household economic environment

What is the link between inflation and household perceptions of past and future prices?

Every month since 1987, INSEE has questioned households about their economic environment and certain aspects of their personal economic situation; the results are published in the monthly household economic survey. Respondents are thus asked about their opinions relating to past developments and prospects for changes in the standard of living, their personal situation, unemployment, their savings capacity, their opportunity to make major purchases and to save. , and on the evolution of prices.

The households surveyed must therefore answer the questions: “Do you find that, over the last twelve months, prices have… increased significantly (+) / increased moderately / increased a little (−) / stagnated (−) / decreased (−) )” and “Compared to the last twelve months, what do you think will be the price development over the next twelve months?” The increase will be faster (+) / the increase will continue at the same pace / the increase will be less rapid (−) / prices will remain stationary (−) / prices will decrease (−).” For each of these questions, a pay is calculated by making the difference between the percentages of positive (+) and negative (−) responses, with “don’t know” responses not included in the calculation. Historically (between January 1987 and December 2023), the average of the balance of past price developments is −13 while that of future price developments is −31. The consumer price index was on average between January 1991 and December 2023 +1.7% year-on-year.

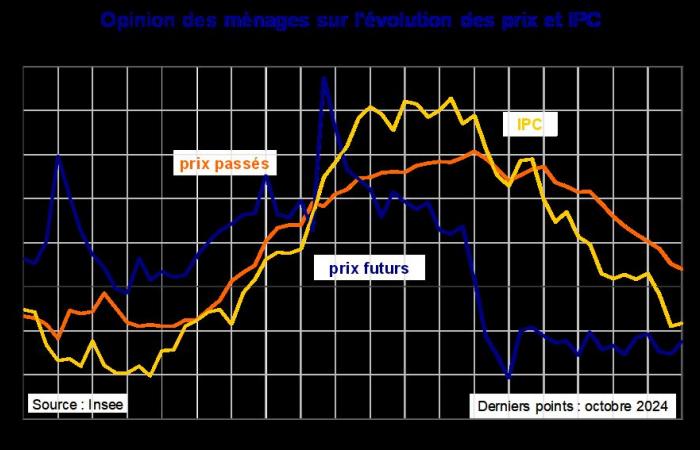

Between 1991 – start of the consumer price index (CPI) series – and 2023, the balance relating to past price developments was on average −11 while that relating to the outlook for price developments was on average of −31. Over the same period, the CPI had an average annual shift of +1.7%. Above all, we see that in periods of high inflation, the balance relating to past developments increases very quickly and it normalizes once the peak has passed. The balance on the outlook also reacts strongly to inflation, but its normalization occurs more quickly.

The recent period has not deviated from this rule, with a very strong and rapid increase in the balance relating to past prices from the start of the price increase (from −40 in February 2021 to 44 in February 2022) and until reaching its peak at 78 in April 2023 at the peak of the inflationary episode (peak at +6.3% yoy in February 2023). Likewise for the balance relating to the outlook for price developments, the start of the inflationary episode led to strong growth (from −28 in February 2021 to 38 in March 2022, including +50 in this month alone) quickly reversed : since May 2023, this balance has been well below its long-term average. This low level, in a context of slowing prices, is logical given the accounting of the responses: only the anticipations ofacceleration prices are counted positively.

Thus, the results of the October survey present a balance relating to the past evolution of prices which continues to decline (−4 pt to −1) and reached its lowest level since August 2021, but remains above its historical average (historical average at −13). This decrease is consistent with the continuation, well underway, of disinflation, the extent of which, however, does not yet seem to be fully understood. Likewise, the share of households anticipating price increases in the next 12 months is increasing: the balance relating to future prices gains +4 pt and stands at −49, still well below its long-term average (−31).

Reading note: in July 2024, the balance of opinion on past prices was one standard deviation (left scale) higher than its long-term average (1987-2023), while the balance of opinion on future prices was one standard deviation below its long-term average, and l’inflation was +2.3% year-on-year (right scale), or +0.3 pt above the European Central Bank's target.