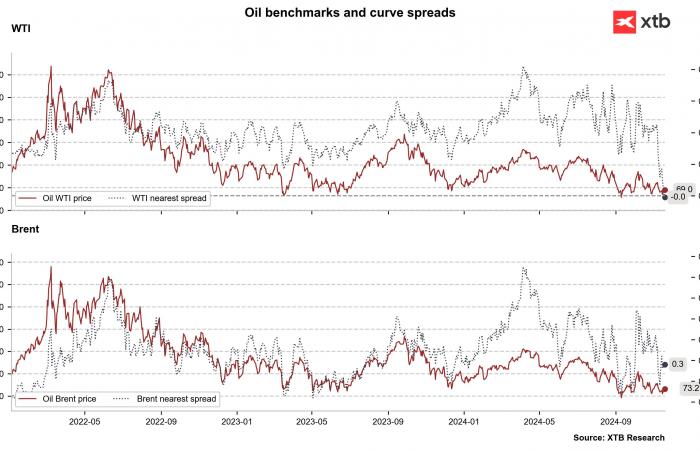

Oil prices jumped more than 3% yesterday, with Brent at $73.12 and WTI at $69.16, mainly due to significant supply disruptions and escalating tensions geopolitics. The immediate market reaction followed the announcement of a complete shutdown of production at Norway’s Johan Sverdrup field, Western Europe’s largest oil field producing 755,000 barrels per day, due to a power outage. electricity on dry land.

Additionally, the Chevron-operated Tengiz oil field in Kazakhstan has reduced production by 28-30% due to maintenance work on a recovery boiler, with repairs expected to continue until November 23. These combined disruptions temporarily reduced global supply by almost a million barrels per day.

U.S. Gulf Coast refineries are currently operating at the highest seasonal rates in more than three decades, processing 9.31 million barrels per day. The surge in activity is driven by strong demand for products from Mexico and Brazil, with U.S. product exports expected to reach 2.96 million barrels per day this month, the highest level in seven years . Strong export demand has pushed refining margins (3-2-1 crack margin) to their highest levels since August.

The market is also reacting to escalating tensions in the Russia-Ukraine conflict, with the Biden administration authorizing Ukraine to use U.S.-made weapons to carry out deep strikes in Russia. This development introduced an additional geopolitical risk premium into oil prices, particularly following the largest Russian airstrike on Ukraine in almost three months.

Meanwhile, major oil companies including BP, Shell and Equinor are refocusing on traditional investments in oil and gas, scaling back their energy transition plans amid concerns about the profitability of renewable energy. The strategic shift comes as the IEA forecasts peak oil demand by the end of the decade and a potential supply surplus of one million barrels per day by 2025.

The WTI market structure moved into contango for the first time since February 2024 ahead of the December contract expiration, indicating near-term glut concerns despite current supply disruptions. This technical development, combined with a widening of the Brent-WTI spread, suggests underlying market complexity as traders balance immediate supply constraints against longer-term demand uncertainties.

OIL (D1 interval)

Oil is trading near key resistance at the 23.6% Fibonacci retracement level. The RSI shows a gradual bullish divergence, with the MACD tightening towards a potential buy signal. Bulls aim to retest the 50-day SMA at $74.04, while bears focus on September lows. Source : xStation

“This content is a marketing communication within the meaning of Article 24(3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/ 92 /EC and Directive 2011/61 /EU (MiFID II) The marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No. 596/. 2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (Market Abuse Regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Directives 2003/124/EC, 2003/125 / EC and 2004/72 / EC of the Commission and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No. 596/2014 of the European Parliament and of the Council with regard to standards regulatory techniques relating to technical arrangements for the objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for the disclosure of special interests or indications of conflicts of interest or any other advice, including in the field of investment advice, within the meaning of article L321-1 of the Monetary and Financial Code. All information, analyzes and training provided are provided for informational purposes only and should not be interpreted as advice, a recommendation, a solicitation for investment or an invitation to buy or sell financial products. XTB cannot be held responsible for the use made of it and the resulting consequences, the final investor remaining the sole decision-maker regarding the position taken on their XTB trading account. Any use of the information mentioned, and in this regard any decision taken in relation to a possible purchase or sale of CFDs, is the exclusive responsibility of the final investor. It is strictly prohibited to reproduce or distribute all or part of this information for commercial or private purposes. Past performance is not necessarily indicative of future results, and anyone acting on such information does so entirely at their own risk. CFDs are complex instruments and carry a high risk of rapid loss of capital due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You need to make sure that you understand how CFDs work and that you can afford to take the likely risk of losing your money. With the Limited Risk Account, the risk of losses is limited to the capital invested.”

Canada