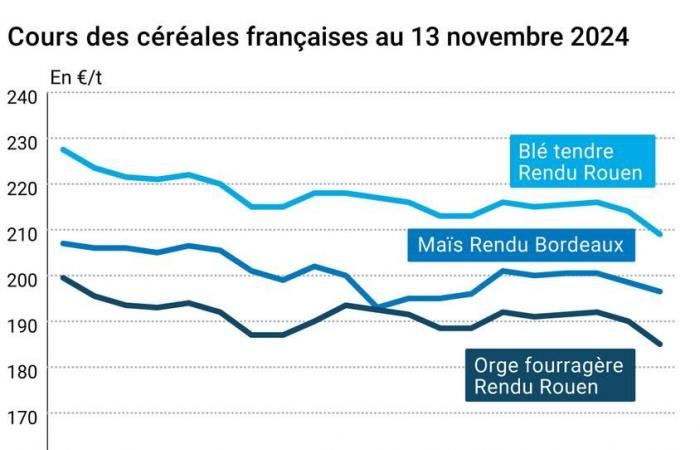

THE prix of the main futures contracts on the wheat have again lost ground significantly on the futures market CBOT between November 12 and 13. The December deadline is back at the level of 541 cts$/bushel and that of March (the most traded) has fallen below 560 cts$/bushel. The reduction, valid for all maturities, is between 9.5 and 11.25 cts/bushel. On Euronextthe wheat contract lost ground, a little more than the day before, particularly on the close. The courses of but on the futures markets also lost some ground. The December contract fell below €210/t and the March contract was close to €220/t.

In the weekly position report of Euronext traders, as of Friday November 8, we note that so-called financial operators increased their net short position in wheat (by around 12,000 lots) to reach around -143,000 lots and on the https://www.reussir.fr/ladepeche/ble corn (around 700 lots) to reach around -2,600 lots.

On the markets hexagonal physical figures, the prices of soft wheat, corn andbarley fodder lost ground while those of durum wheat progressed a little.

To find out everything about agricultural market news, click here

The dollar still puts pressure on the markets, due to its strength in the face ofeuro and most others devises while the sales of corn are always supported at the start of UNITED STATES. Theoretically, this decline of the euro against the dollar (parity at $1.056 on Wednesday against $1.062 on Tuesday) should favor exports European. The wheat and corn futures markets were driven by technical sales and investment fund bellies across the Atlantic. There harvest of corn could end this week in the United States. We are expecting an update of the corn balance sheets from Brazilian Conab this Thursday. On the wheat side, global operators are keeping a close eye on growing conditionstherefore meteorology, in Europe, Russia and Ukraine.

In Francethe specialized “Large crops” consultancy of FranceAgriMer published its monthly cereal balance sheet updates this Wednesday, November 13 (see Fundamentals below). On the export side, the situation is evolving as follows: the organization forecasts 130,000 t less on soft wheat exports for the current campaign (including -100 kt to third countries, with the absence ofAlgeria which is now being felt) while sales to the European Union are revised to show a very slight increase in barley. Corn exports are revised upwards (+75 kt, including 55 kt to the EU). Regarding Algeria, Benoît Piètrement, president of the specialized “Large crops” council of FranceAgriMer, indicates that“it is now necessary to find new markets and maintain our traditional markets” for the current campaign.

The courses of oil recovered on Wednesday, “encouraged by an American price index which does not call into question the hypothesis of a continuation of the ongoing monetary easing, itself a factor supporting demand for black gold”, according to the AFP. France has also clarified, via its Prime Minister Michel Barnier, that it “will not accept theEU-Mercosur free trade agreement in current conditions” following a meeting with the President of the European Commission Ursula von der Leyen, again according to AFP. The GDP for the third quarter of the euro zone is published today by Eurostat and the European Central Bank will publish the minutes of its October monetary policy meeting early this afternoon. L’International Energy Agency also publishes its monthly oil report.

To find out everything about the latest news from professionals in the grain sector, click here

Fundamentals:

- France, soft wheat, production : revised month-on-month increase of 127 kt for 2024-2025, to 25.555 Mt, down 27% compared to 2023-2024 (source: FranceAgriMer);

- France, soft wheat, uses : revised month-on-month decrease of 181 kt for 2024-2025, to 24.141 Mt, down 23% compared to 2023-2024 (source: FranceAgriMer);

- France, soft wheat, final stock : revised upwards from one month to the next by 272 kt for 2024-2025, to 2.784 Mt, down 12% compared to 2023-2024 (source: FranceAgriMer);

- France, barley, production : revised month-on-month decrease of 52 kt for 2024-2025, to 9.853 Mt, down 20% compared to 2023-2024 (source: FranceAgriMer);

- France, barley, uses : reviews up month-on-month by 38 kt for 2024-2025, 8,403 Mt, down 19% compared to 2023-2024 (source: FranceAgriMer);

- France, barley, final stock : revised upwards from one month to the next by 10 kt for 2024-2025, 1.362 Mt, up 7% compared to 2023-2024 (source: FranceAgriMer);

- France, corn, production : revised month-on-month increase of 160 kt for 2024-2025, to 13.635 Mt, up 13% compared to 2023-2024 (source: FranceAgriMer);

- France, corn, uses : reviews up month-on-month by 275 kt for 2024-2025, to 11.756 Mt, up 11% compared to 2023-2024 (source: FranceAgriMer);

- France, corn, final stock : revised downward from one month to the next by 83 Kt for 2024-2025, to 2.36 Mt, up 18% compared to 2023-2024 (source: FranceAgriMer);

- France, durum wheat, production : revised month-on-month increase of 6 kt for 2024-2025, to 1.217 Mt, down 6% compared to 2023-2024 (source: FranceAgriMer);

- France, durum wheat, uses : reviews up month-on-month by 4 Kt for 2024-2025, to 1.295 Mt, down 20% compared to 2023-2024 (source: FranceAgriMer);

- France, durum wheat, final stock : revised upwards from one month to the next by 5 kt for 2024-2025, to 145 Kt, up 4% compared to 2023-2024 (source: FranceAgriMer);

- Ukraine, wheat, production: revised to 21.1 Mt for 2025, down compared to the five-year average (source: SovEcon).

Commerce international :

- United States, corn, export sales : 401,357 t to Mexico and 290,820 t to an unspecified destination, for delivery in 2024-2025 (source: USDA).

European export and import as of November 10:

(source: European Commission)

| in tonnes | Cumulative 2024/25 | S19 2024/25 | Cumulative 2023/24 | S19 2023/24 |

| Soft wheat (export) | 8 342 051 | 223 323 | 11 964 585 | 631 201 |

| Barley (export) | 1 766 076 | 34 992 | 2 825 696 | 51 765 |

| But (export) | 601 093 | 96 712 | 971 465 | 70 780 |

| But (import) | 7 103 883 | 119 387 | 6 557 957 | 388 254 |

French physical markets from November 13, 2024 (July base for cereals)

| Soft wheat | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Dunkirk rendering | 220/11 miller Harvest 2024 | Nov.-Dec. | 209,50 | N | -7,50 |

| Rendering La Pallice | 76/220/11 Harvest 2024 | Nov.-Dec. | 209,00 | A | -8,00 |

| Rendering Rouen | 76/220/11 Harvest 2024 | Nov.-Dec. | 209,00 | N | -7,00 |

| Pontivy/Guingamp rendering | forage 74 kg/hl base, 72 kg/hl mini Harvest 2024 | Nov.-Dec. | 213,00 | N | 5,00 |

| Fob Moselle | miller Harvest 2024 | Nov.-Dec. | 217,00 | T | -2,00 |

| Fob Rouen | FCW Superior A2 class 1 major. included Harvest 2024 | nov. | 217,62 | -3,60 | |

| FCW Medium A3 class 2 major. included Harvest 2024 | nov. | inc. | |||

| Fob La Pallice | FAW Superior A2 class 1 major. included Harvest 2024 | nov. | 218,82 | -3,60 | |

| Departure from Marne | BPMF 220 Hagberg Harvest 2024 | Jan-Mar | 220,50 | T | -5,00 |

| Departure from Eure/Eure-et-Loir | BPMF 76 kg/hl Harvest 2024 | Jan-Mar | 213,00 | N | -5,75 |

| Departure South-East | miller Harvest 2024 | Jan-Mar | n.p. |

| Durum wheat | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Port-la-Nouvelle | semolina standards Harvest 2024 | Nov.-Dec. | 300,00-305,00 | N | 2,50 |

| Departure from Eure/Eure-et-Loir | semolina standards Harvest 2024 | Nov.-Dec. | 295,00-300,00 | N | 5,00 |

| Departure South-East | semolina standards Harvest 2024 | Nov.-Dec. | 290,00 | N | 0,00 |

| But | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Bordeaux rendering | Harvest 2024 | Nov.-Dec. | 196,50 | N | -2,00 |

| Rendering La Pallice | Harvest 2024 | Nov.-Dec. | 197,50 | N | -4,00 |

| Pontivy/Guingamp rendering | Harvest 2024 | Nov.-Dec. | 204,50 | T | -3,00 |

| Fob Bordeaux | Harvest 2024 | Nov.-Dec. | 200,50 | N | -4,50 |

| Fob Rhin | Harvest 2024 | Nov.-Dec. | 203,00 | N | -5,00 |

| Harvest 2024 | Jan-June | 213,00-214,00 | T | -2,50 | |

| Departure South-East | Harvest 2024 | Nov.-Dec. | n.p. |

| Feed barley | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Rendering Rouen | 62-63 kg/hl Harvest 2024 | Nov.-Dec. | 185,00 | N | -5,00 |

| Pontivy/Guingamp rendering | Harvest 2024 | Nov.-Dec. | 187,00-188,00 | N | -6,50 |

| Fob Moselle | without limit. orgettes Harvest 2024 | Nov.-Dec. | 182,00 | N | -3,00 |

| Departure from Eure/Eure-et-Loir | Harvest 2024 | Nov.-Dec. | 173,00 | N | -9,00 |

| Departure South-East | 62/63 kg/hl Harvest 2024 | Nov.-Dec. | n.p. |

| Malting barley – Winter 6 rows | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Fob Creil | Faro 11.5% max Port 500 t Harvest 2024 | Nov.-March | 224,00 | N |

| Malting barley – Spring | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Fob Creil | Planet 11.5% max Port 500 t Harvest 2024 | Nov.-March | 235,00-237,00 | N |

Quotations of milling products from November 12, 2024

| Its fine soft wheat | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Ile-de-France | available. | 125,00-127,00 | T | ||

| pellets | available. | 134,00-136,00 | T |

| Half-white remolding | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Ile-de-France | available. | 164,00-166,00 | T |

| Low flour | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| Departure from Ile-de-France | available. | 168,00-170,00 | T |

Commercial quotes for dairy products from November 7, 2024

| Milk powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days 5% H BT bulk | available. | 2420,00 | N |

| Whey powder | Specifications | Due date | euro/t | Variation | |

|---|---|---|---|---|---|

| NBPL departure at 30 days, BILA pH 6 bulk | available. | 855,00 | N |

Evolution dollar / euro du 13 novembre 2024

| Devise | Closing value |

|---|---|

| 1 dollar US | 0,9408 euro |

| 1 euro | 1,0629 dollar |

Chicago Futures Market Closes November 13, 2024

| Raw materials | Fence | Chicago |

|---|---|---|

| Wheat | 541,00 | cents/wood. |

| But | 426,50 | cents/wood. |

| Ethanol | 2,161 | $/gallon |

Closing of the Euronext futures market on November 13, 2024

| Milling wheat (Euronext) | |

|---|---|

| Echéance | Fence |

| Dec. 2024 | 209,50 |

| Mars 2025 | 220,25 |

| May 2025 | 225,50 |

| Volume | 136485 |

| Corn (Euronext) | |

|---|---|

| Echéance | Fence |

| Mars 2025 | 206,25 |

| June 2025 | 210,25 |

| August 2025 | 214,50 |

| Volume | 3933 |

International market quotes from November 13, 2024

| Energy | Echéance | Closing value |

|---|---|---|

| Oil (Nymex) | Dec. 2024 | 68,43 $ |

| Ocean freight indices | from November 13 | Variation |

|---|---|---|

| Baltic Dry Index (BDI) | 1630 | -4,00 |

| Baltic Panamax Index (BPI) | 1208 | 14,00 |

| Baltic Capesize Index (BCI) | 2746 | -7,00 |

| Baltic Supramax Index (BSI) | 1036 | -15,00 |

| Baltic Handysize Index (BHSI) | 693 | -4,00 |