The context of climate emergency requires us to seek all exploitable solutions to reduce the carbon footprint of all mobility. Among the alternative energies to non-road diesel (NGR), bioCNG presents interesting potential and should not be neglected in France for the transport of passengers and goods by river and coastal maritime navigation. This is what emerges from a study carried out jointly by GRDF and Ademe, with the participation of Voies navigables de France (VNF).

Concerning river and coastal maritime navigation, it is possible to replace GNR with HVO obtained from vegetable oils and reprocessed waste, synthetic fuel (BTL from biomass, CTL with coal, GTL using natural gas) , hydrogen, methanol, electricity to be stored in batteries, and bioNGV produced from biomass.

Entitled “Potential of bioCNG in river and coastal maritime navigation”, the study by Ademe and GRDF focuses on bioCNG which makes it possible to obtain from the well to the propeller a reduction of up to 88% in gas emissions greenhouse effect. The gains are also interesting regarding discharges of hydrocarbons (from -84 to -92%), nitrogen oxides (-62 to -95%) and fine particles (-92 to -97%).

Regulatory blockages

Unlike maritime navigation, there is currently no clear regulatory framework authorizing NGV for river and coastal shipping. This is holding back shipowners, engine manufacturers and design offices who are hoping for a change in the legislation as quickly as possible.

Based on the EMNR (non-road mobile machinery) regulation and the requirements of ES-TRIN, the regulations do not authorize, unless exempted, fuels which have a flash point lower than 55° C. Which excludes the general case CNG/bioCNG (-188° C) but not diesel (70° C). A situation which could change favorably in 2026.

Pushers, barges and ferries

Overall, bioCNG appears “particularly well suited to captive or semi-captive fleets which operate at regular and moderate speeds”, highlights the study. Faced with the great heterogeneity of the boats used in these frameworks, the editors have chosen to retain only the three most representative types. Already because of a minimum size necessary to accommodate the storage of bioCNG on board.

Two concern freight. These are the barge pushers and self-propelled (barges). Added to this are the river and sea ferries designed mainly to transport people and vehicles between two banks.

River and maritime ferries are part of the three categories targeted by the study carried out by Ademe and GRDF

In the 101-page report, the engine architectures operating with biomethane and already included in projects are listed. The natural gas engine with a controlled ignition circuit close to a gasoline unit has already been selected for the re-powering of river ferries and Aries pushers.

Hybridization and marinization

More complex is hybridization where it is an electric motor which allows propulsion, a generator with bioCNG tank used to power it and maintain the charge level in a buffer battery.

This architecture is recommended for new units for three reasons. Already for the optimization of thermal efficiency and the possibility of changing energy sources according to changes in regulatory constraints. But also because it allows several generators to be installed depending on the needs of the boats. Operating then on the best efficiency ranges, they can be turned off one after the other depending on the energy demand. With the downside, however, of the faster drop in efficiency on a gas engine than on a diesel unit. Which leads to working on groups with variable speed. The CNG/electric series hybridization was retained in a new pusher project and three re-engines (Green Deliriver, Andromeda and Grand Pavois).

Last possibility: marinization. Behind this word, unknown to general dictionaries, lies the technology by which a road engine is adapted for the propulsion of boats. There is already a candidate compliant with EU Directive 2016/1629 and Stage V approved. This is the MAN E2862 495 kW 12-cylinder V block, usable only as a generator. Two more could follow. They are in the catalogs of Europe Service (92 kW, AV MAG R756) and NGV Powertrain (230 kW, FP087), both in 6-cylinder in-line configuration.

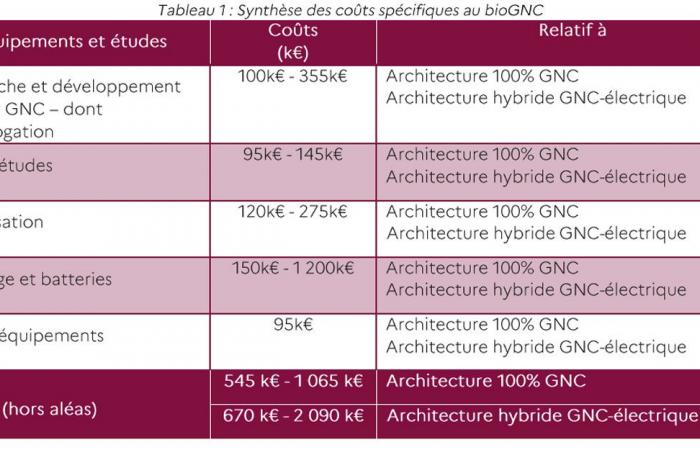

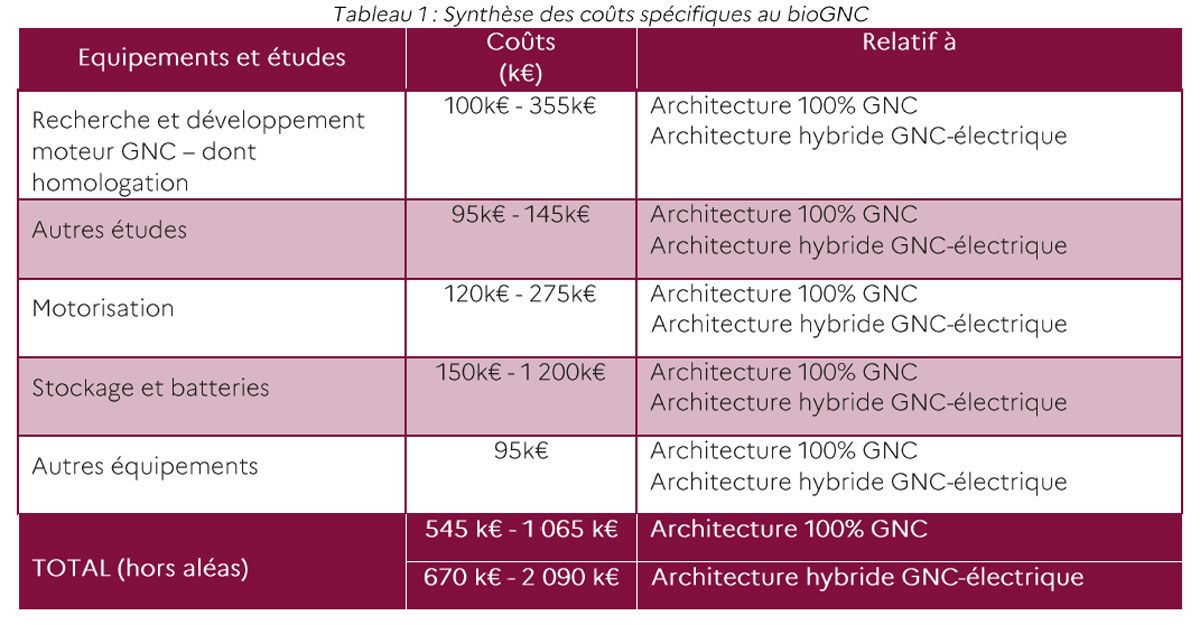

Cost of a bioCNG re-engine

Regardless of the bioCNG propulsion solution chosen, excluding hazards, a significant additional cost must be taken into account compared to diesel. It is between 545,000 and 1,065,000 euros for a classic thermal engine, and between 670,000 and 2,090,000 euros with a CNG/electric hybridization. These sums are divided into 5 items: R&D including approval, other studies, motorization, gas storage and new or recycled batteries, other equipment.

Note that economic losses may possibly be caused by the space taken for energy storage. What a revision of the operating plan can sometimes more or less compensate for. Interviews carried out by GRDF and Ademe with pioneering players showed that costs could be moderate in use by only lowering the navigation speed by 1 or 2 km/h, but also upstream by avoiding oversizing the engines.

Aid and supplies

If CNG-electric hybridization appears more expensive, the greater flexibility it brings in operation places it as a progressive transition solution. As such, it benefits from a specific share of funding for studies as part of the fleet modernization and innovation assistance plan (PAMI).

Wanting to switch to bioCNG can make it possible to obtain other aid, such as that of the Gate system of the CEE Remove program for the greening of fleets, or from the European fund FEDER and the region. Decorrelating the price of bioNGV from that of other energies and exempting it from excise duties would constitute two other moderating incentive levers.

If there is no accessible public station or possible refueling by truck, it will be necessary to provide one at least sized for operating needs, financially lighter for the parties if it is shared.

In a simple configuration, for a capacity of 40 Nm3/h, it would cost around 100,000 euros excluding taxes. For two distributors of 120 Nm3/h each, the bill would be between 250,000 and 280,000 euros without storage, but it would increase to 330,000-380,000 euros if there is one. We climb to 1.3-2 million euros with a capacity of 1,500 to 2,000 Nm3/h. It would also be necessary to budget from 90,000 to 300,000 euros for the development along the waterway for the berthing station.

Outlook: three scenarios considered

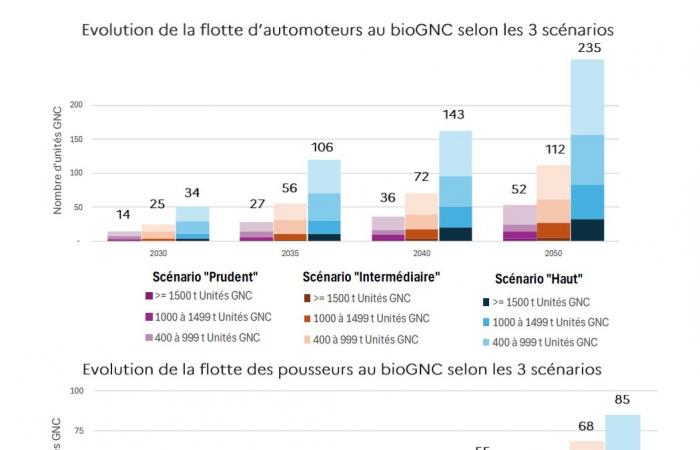

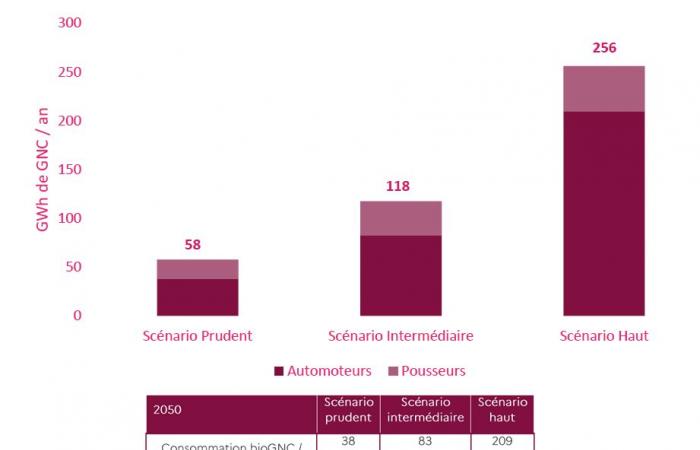

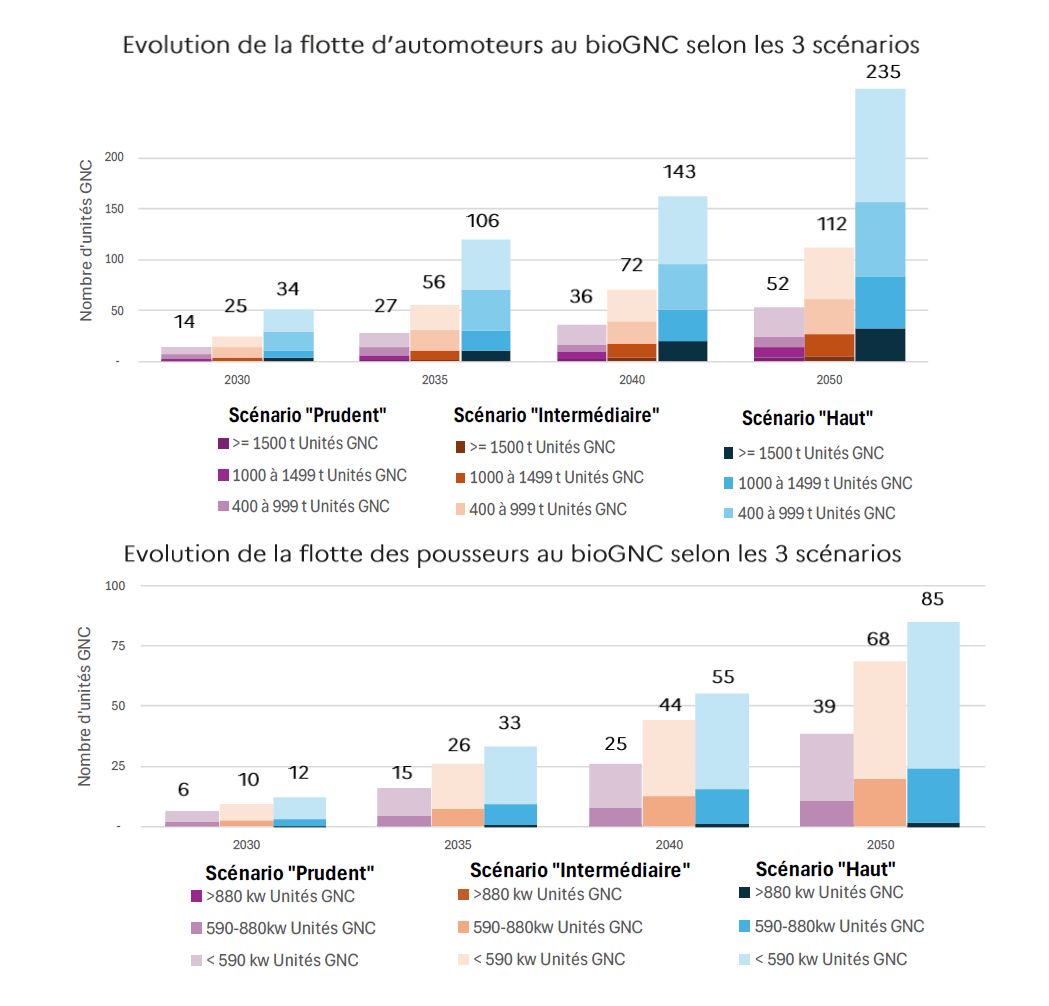

GRDF and Ademe have imagined three scenarios (cautious, intermediate and high) around 2050 for the development of bioCNG for pushers and barges with stages at 2030, 2035 and 2040. At the final deadline, out of a total number of 147 pushers , models running on bioCNG could respectively represent 39, 68 or 85 units. As for barges, the gap between the extremes is greater, between 52 and 235 bioCNG boats out of 457 and 672 self-propelled boats respectively.

These prospects would translate in 2050 into an annual consumption of bioCNG for freight of 58, 118 or 256 GWh depending on the scenarios, including 38, 83 or 209 GWh for self-propelled vehicles and 20, 35 and 47 GWh with pushers.

Sticking to an average potential of 130 TWh of biomethane produced annually in 25 years, the share that these boats would consume appears anecdotal: 0.04% (cautious), 0.09% (intermediate) or 0. 19% (high). The lack of numerical data did not allow the editors to make precise projections regarding ferries for the transport of passengers and vehicles.

An energy unknown to the actors

The study points out that bioCNG propulsion is often not considered in the context of new construction or re-powering for river and coastal maritime navigation. And this is due to a lack of knowledge of the players in the sector, of the environmental virtues, of the experiments in progress, of the engines available, etc.

There is also a phenomenon that is similar to the eternal chicken and egg problem. On the one hand, shipowners, engine manufacturers and design offices are waiting for a favorable regulatory framework to launch with the assurance of arriving at a solution that they can exploit. On the other hand, the authorities in charge of the texts seem to be waiting for demonstrators to develop lasting standards specific to bioCNG propulsion.

This is why GRDF and Ademe emphasize the importance of communication and collaboration between all impacted stakeholders. Those responsible for operating boats must take into account that the use of this alternative fuel requires larger storage spaces on board for lower ranges. Hence some questions to ask concerning more frequent and/or longer refueling stops, improving the efficiency of the propulsion chain, modifying the balance of the units, etc. In any case, before deciding for an alternative energy rather than another to replace diesel, they must be compared for the needs of each farm. Once adopted, bioCNG propulsion will require crew training.

Recommendations

After studying the possibilities, the projections, and observing the potential obstacles, the rapporteurs made several recommendations. Some have already been swept aside, such as the evolution of the regulatory framework which could include the creation of a more flexible experimentation system for the first models in order to limit the approval time.

Biomethane should also be recognized as a low-carbon fuel at European level for the allocation of financing aid. Concerning the communication aspect, bioCNG should be present in the various decarbonization roadmaps for river and maritime navigation.

Ademe and GRDF are also counting on the sustainability of calls for projects, the creation of specifications with “ description of the technical changes to be made to the engines during marinization », and the updating of VNF notebooks for boatmen.

The last point concerns refueling with emergency solutions based on gas delivery by tanker truck or containers while waiting for an accessible network. For the economic profitability of the latter, pooling (river, road, rail) with other territorial stakeholders is recommended. The land for the location of the stations should be secured as quickly as possible to avoid or reduce the tensions already observed.

If Gaz-Mobilite.fr informs you free of charge and without advertising on all the latest news in the NGV sector, it is thanks to the support of around forty partners.

Subscribe for free to our newsletter and receive all the news on CNG and biomethane every week