The SNB kept its word. After the Board of Directors under the old President Thomas Jordan gave a strong indication that the downward path would continue in December, his successor Martin Schlegel has now lowered the key interest rate in Switzerland. The fourth reduction in a row of 50 basis points represents an acceleration.

The Swiss National Bank (SNB) has reduced the key interest rate by 50 basis points from 1.00 percent to 0.50 percent. “The underlying inflation pressure has decreased again this quarter. With today’s easing of monetary policy, the National Bank is taking this development into account,” says the media release on the monetary policy assessment.

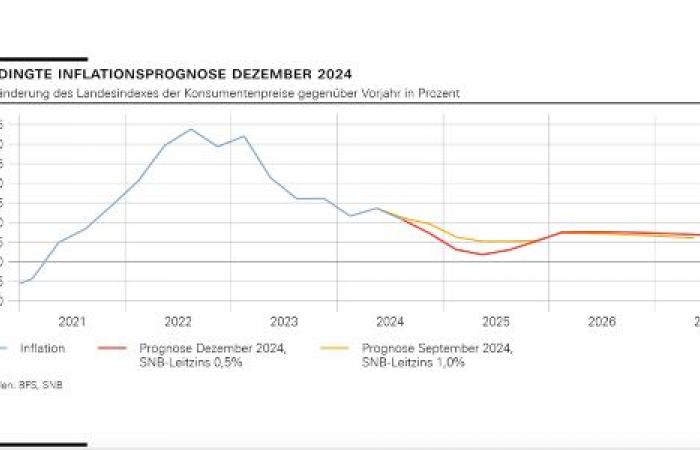

Inflation in Switzerland is well below the upper limit of the target range of 0 to 2 percent. According to the BFS figures, inflation rose slightly in November to 0.7 percent compared to the same month last year – after 0.6 percent in October – but it remains very low.

Further decline in inflation expected

The SNB’s new forecast is within the price stability range over the entire forecast period. The annual average is 1.1 percent for 2024, 0.3 percent for 2025 and 0.8 percent for 2026. The forecast is based on the assumption that the key interest rate is 0.5 percent over the entire forecast period. Already in September, the inflation estimate for the coming year was significantly reduced to 0.6 percent from the previous 1.1 percent.

The National Bank also takes the Swiss franc exchange rate into account when setting interest rates. The franc is currently trading at 0.9288 against the euro and at 0.8839 against the dollar. A devaluation of the franc is in the interests of the Swiss export industry. On the other hand, imported inflation caused by more expensive goods from abroad is not a major concern at the moment. Inflation in the euro zone has also weakened significantly in recent months.

Subdued economy

In Switzerland, gross domestic product (GDP) grew only moderately in the third quarter of 2024, as expected, the SNB continues. GDP growth of around 1 percent is expected for the current year and growth of between 1 and 1.5 percent for 2025. In this environment the…

Unemployment will continue to rise slightly, while utilization of production capacity is likely to fall slightly.

At noon, the Council of the European Central Bank under President Christine Lagarde will decide on interest rates in the euro zone. The majority of economists expect a reduction of 25 basis points to 3.00 percent (deposit rate).

More to come.

Swiss