Trumpism is part of an ancient tradition of a certain American establishment: Americanism, that is to say a vision of democracy and capitalism constantly returning to the spirit of the Founding Fathers of the American Revolution. (credit: Elijah Nouvelage / AFP)

Trumpism will profoundly and lastingly change the distribution of global economic growth. This new policy calls into question a significant part of the dominant thinking of the last 30 years.

Trumpism, populism or Americanism?

European media have often described Trump as a populist, even an isolationist. His style would be autocratic or even fascistic.

The study of the donors of his campaign or his government team does not correspond to these labels. The largest donor is the grandson of Andrew Mellon, grandson of a US Treasury Secretary and a prominent member of America’s longest-serving Establishment.

Trumpism is part of an ancient tradition of a certain American establishment: Americanism, that is to say a vision of democracy and capitalism constantly returning to the spirit of the Founding Fathers of the American Revolution.

Trumpism can thus be compared to Theodore Roosevelt’s Square Deal against the Rober Barrons (cartels) of the late 19th century, or even Franklin Roosevelt’s New Deal.

A questioning of scientific truth as a source of political decisions?

Trump’s appointment of Anti-Covid to the FCA, of energy climate skeptics could have a considerable impact if it revealed possible corruption or even collusion between technocrats and green energy or pharmaceutical lobbies.

The management of global warming and the COVID crisis raises the problem of this relationship between scientists and politicians.

Since Karl Popper, it has been accepted that a scientific truth which declares itself definitive is in essence false, starting with Marxism. It is the meeting of divergent scientific thoughts which little by little reveals the Truth which always recedes as science advances.

Since Max Weber and his seminal book: “The Scientist and the Politician”, it was also accepted that the scientific ethics of conviction could never be combined with the political ethics of responsibility and therefore sometimes compromises (Real Politik)

What program for Trumpism?

The key phrase of Trumpism is MAGA, “Make America Great Again.” The founding hypothesis is that the American people have been impoverished by a globalist elite who would not act for the interests of the people but for their own (plutocratic drift). This includes:

· Tax imports on China, Mexico and Canada or even the rest of the world to create tax revenue and promote the reindustrialization of the country, and force Mexico and Canada to better control the border (immigration and drugs)

· Return illegal immigrants and finish building the wall with Mexico. Reduce the social cost of illegal immigrants, limit drug crime, force China to block Fentanyl trafficking which is killing tens of thousands of Americans, limit competition for low wages, and encourage selective and more qualified immigration.

· Dismantle the Democrats’ Green Plan; reopening of shale gas in fracking, reduction of subsidies for electric vehicles, exit from the Paris agreements.

· Dismantle extra-financial accounting and ESG.

· Negotiate Peace in Ukraine with Russia.

· Destroy the “Deep State” and reduce the Federal State. Clean up the swamp. with the appointment of Elon Musk to this position.

· Reform the FDA (drug control unit) with the appointment of an anti-vax Kennedy.

What financial impact of these measures?

If this entire program is applied, we will have a significant challenge to the globalist, internationalist model of the last 30 years that we call the Kissingerian Order. This is historically reminiscent of the rapid collapse of the Bismarkian Order following the accession of William II.

USA/Europe, a great distance and/or a great downgrading?

History shows that major American political and economic developments always impact Europe within 3 to 4 years. There is already a growing divorce between public opinion and the media on Trumpism. This poses a real systemic problem in the medium term.

The 2024 Nobel Prize in Economics provides a fascinating interpretation of this growing gap between American and European democracy.

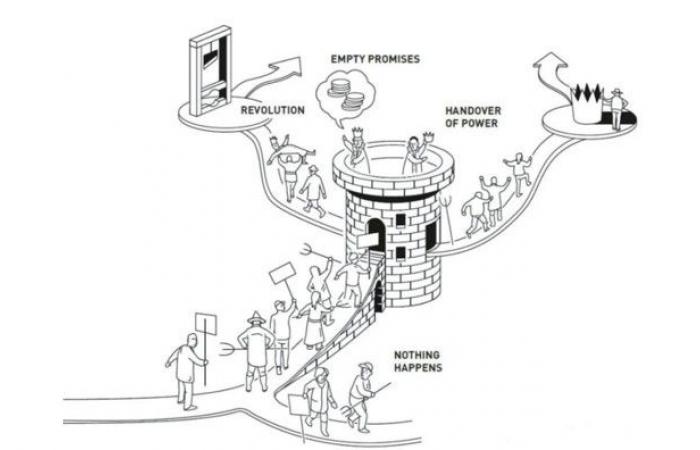

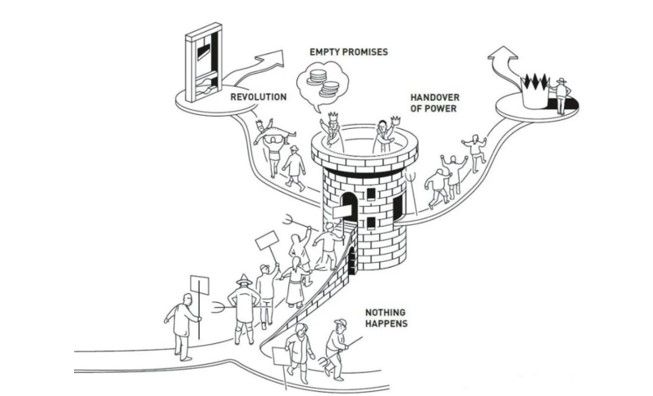

The following graph explains the impact of the democratic system on political stability in the face of the people/establishment relationship and the institutional framework. The key question is whether European institutions will allow orderly evolution following the disruption of Trumpism.

Source: Swedish Academy of Sciences

What growth scenarios?

For globalists, Trump will create stagflation (inflation and recession) with loss of purchasing power, particularly for the less wealthy.

For others, Trump will create a new Golden Age (reflation means growth without inflation). The American GNP has artificially stagnated for 30 years below its potential linked to the growth of its active population and productivity gains linked to AI and other technological revolutions. By reducing non-productive spending like immigration, the war in Ukraine, decarbonization, and the Deep State, the United States can close the growth gap between potential and actual GNP.

The opposite development between the USA and Europe will create increasing tension. It will end either in a policy reversal on one side of the Atlantic or the other, or in a major geopolitical earthquake.

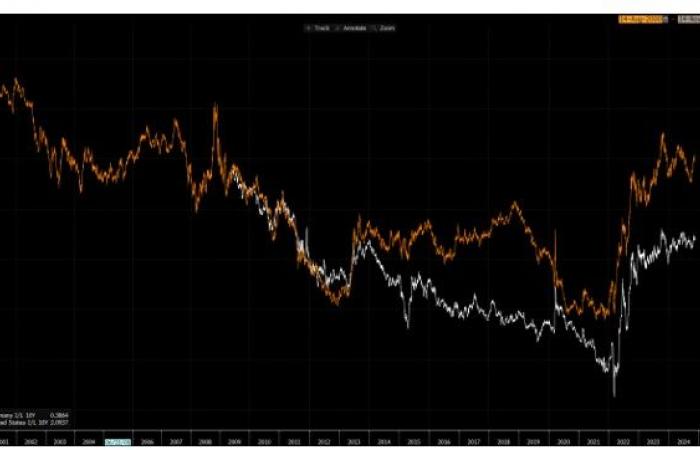

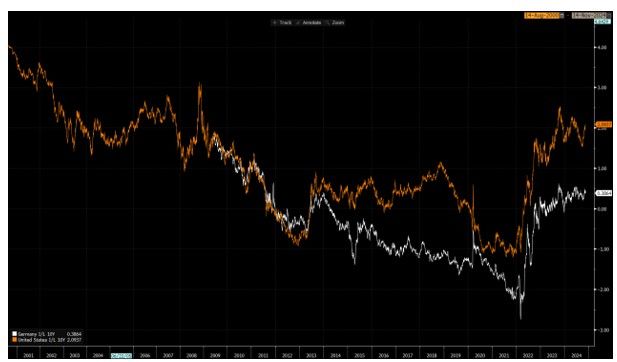

There is a growing divergence between the US and Germany 10-year real rates. This is a very worrying development which reflects the disconnection of Europe from the USA.

Source : Bloomberg LLP

What impact for life insurance?

Towards the return of the King Dollar? The rise in political risk creates a systemic risk on the Euro. The Swiss Franc seems too fragile to us when we see the impact of the bankruptcy of Credit Suisse on the Swiss GNP. Gold seems to us to be grossly overvalued on the basis of long-term purchasing power parity and the rise in long-term real rates linked to the rise in long-term growth potential created by Trumpism. The dollar remains for us. He has certainly risen but will de facto regain his super power. The Trump dollar can be a Reagan dollar.

Lodging its financial assets in systemic financial companies such as Crédit Agricole or BNP. We can also consider American intermediaries such as Interactive Broker, an online broker whose market capitalization is greater than that of Soc Gen.

Exit contracts in Euros. Their performance prospects are worrying. They are underexposed in the USA in the name of the congruence rule, the rise in long-term rates creates a systemic risk for them.

Maintain a GARP investment approach (growth stocks at reasonable prices) but adapt sector biases to Trumpism. We are much more reserved on the Nasdaq. Apple, Microsoft, Google will undoubtedly have to face investigations for cartelization as will the pharmacy. Luxury must be restructured from China to the USA. On the other hand, fossil energy like gas has good prospects. We can also perhaps have an awakening of the mid-smalls who have underperformed for so long.

Conclusion

Analyzing Trumpism is a very difficult exercise even for a financial analyst. Collective financial intelligence seems to go against the collective of many journalists and politicians.

Once again, the “Drang nach Osten” (Conquest of the East via Ukraine) risks ending in the destruction of the dream of a Greater Europe capable of competing with the USA and which would resurrect the Holy Empire or the Roman Empire to complete the project of certain signatories of the Treaty of Rome.

Evariste Quant Research is an independent financial analysis and research firm based on Artificial Intelligence solutions applied to asset management.

This financial analysis is not investment advice. Evariste Quant Research and their clients may hold securities mentioned in this analysis.

DISCOVER THE BURSOVIE LIFE INSURANCE CONTRACT

What if life insurance was made for you?

Do you want to save for long-term projects, such as a future real estate purchase or your children’s studies? Discover BoursoVie life insurance!

Depending on your risk appetite, you can choose the investment supports that interest you with free management – between guaranteed supports (funds in euros) and financial supports (unit-linked supports), or delegate the management of your contract with managed management.

This contract presents a risk of capital loss