This week we cannot exclude the political aspect of the financial markets. In principle it should even be ONLY focused on that. In theory, by Wednesday morning European time, we should know whether Harris or Trump will be president. The problem is that the vote seems so close that it could take much longer than that. We are already talking about weeks of uncertainty to come if the votes have to be recounted 15 times. As a result, perhaps Jerome Powell will have more importance on Wall Street than the two candidates could have. Yes, because by chance of the calendar, the FED will meet and also announce something Thursday evening.

The Audio of November 4, 2024

Download the podcast

The game is almost over

This morning you won’t find a financial media outlet that doesn’t talk about the American elections. Everyone has been digging into the past to see what happens during elections, what happens the day before, the 30 days after and sometimes even until the end of the year. Not sure it changes our lives, because when we compile these numbers together, the only thing we learn is that most of the time the markets are up during an election year and that after the November election, the markets tend to rise “less” at the end of the year. We might as well tell you that this gives us a good leg – in any case after a 25% increase, we don’t really expect much from the last two months that remain. On the other hand, the problem that risks presenting itself is uncertainty. The polls show an election so close that in the event of a necessary recount in certain counties or the “mysterious” disappearance of certain ballots, there is a risk of very strong swings in the American streets and therefore, perhaps on Wall Street as well.

The next few hours will therefore be devoted to the American election and it is unlikely that the speakers will decide to take unnecessary risks in the waiting zone in which we find ourselves. The other thing we know about the post-election period is that volatility tends to increase, which could therefore give us a little more momentum on the indices. But for the rest, this morning we are in “and what could happen if Trump wins” or “and what could happen if Kamala wins” mode. I will spare you the theories on the subject and the “it could be that” and other “Trump is inflationary”, because I remember, eight years ago we were guaranteed a stock market crash in the event of the election of Donald Trump and roughly speaking, we had exactly the opposite. So I think it’s healthy not to try to draw plans on the comet, knowing that in any case, the market has a three-minute vision and is content to fly by sight. One thing is certain, on this Monday morning there is no need to talk about sectoral investment and portfolio strategy for the next 48 hours since until the official announcement of a definitive victory, we are no longer going to see in color, no longer see in black and white, but the only colors we will be able to perceive are blue and red.

Let’s not forget the FED

On the other hand, it is true that even if everyone has their eyes fixed on the polling stations, we tend to forget that from Wednesday until Thursday evening, the FED will meet to decide what they are going to do interest rates. Looking at the recent economic figures that have been published – whether those for inflation or those for employment – it is almost certain that Powell will lower rates by 25 basis points. In addition, he is not expected to provide an update on American economic conditions, since that is scheduled for the December Meeting. The experts therefore expect a calm and surprise-free meeting, which could actually be the best thing that could happen to the market: not having any surprises to deal with in addition to the elections.

Afterwards, it should be noted that some economists are already seeing a little further and saying that if we find ourselves in total uncertainty or if Kamala Harris wins the election and the Republicans take to the streets, the FED “COULD” resign themselves to lowering rates again by 0.5% in order to “reassure a market which would be in panic”. But all this is only conditional, at the moment, the markets are strong, the markets are resilient and it is difficult to imagine that the victory of one or the other will move the indices more than reason enough to push the FED to “intervene” in disaster on Wednesday evening, but it is a scenario which is still envisaged by some.

The clownish employment figures and the market reaction which is even more so

You will have understood, this morning we start the week by talking ONLY about the elections and a little about the FED. On the other hand, what is quite crazy is to see that the employment figures which were published Friday afternoon have already gone to the ace and practically no one talks about them anymore. However, there would be things to say because these data were so filthy. But when we see the reaction of the market on Friday, when we see that most of the European and American indices ALL finished IN positive territory, we understand that the word RESILIENCE is not an empty word and that we now have this incredible ability which is to no longer react negatively to bad news and to move on to something else by ignoring the thing…

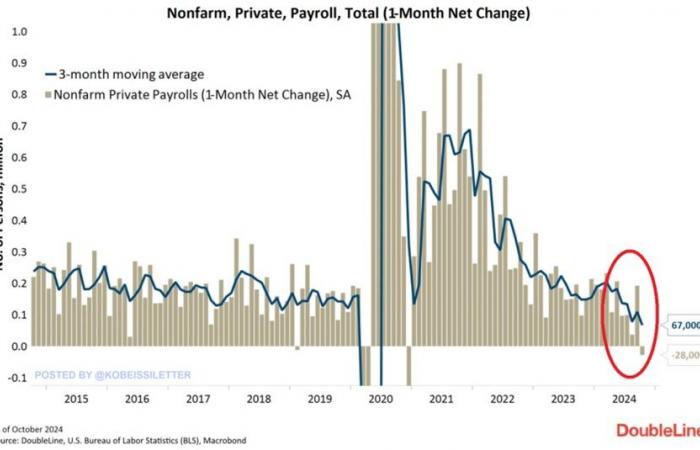

On Friday afternoon, the clowns at the Bureau of Labor Statistics, which is located at the Postal Square Building -2 Massachusetts Avenue in Washington DC and which hides under the acronym BLS, released employment figures that were simply crap. . The US economy created 12,000 jobs in October, which was SIGNIFICANTLY lower than expectations of 106,000. However, the figure of 106,000 did not seem that difficult to beat. For the rest, the unemployment rate was 4.1%, perfectly in line with expectations and it was overall the lowest job creation figure in the USA since July 2021. All the signs continue to improve. ‘indicate a weakening of the labor market, but everyone in the financial world doesn’t care about it like they did in the forties. However, if we also had to pull the plug on the ambulance, we would also remember that the BLS has revised DOWNWARDS the figures for the last two months. Which amounts to saying that the “good surprises” in the figures for the month of September are going by the wayside and that the month of August was worse than expected. Once again, we made investment decisions, we put strategies in place, based on figures that are simply bogus! The Labor Department’s revisions therefore crossed out 112,000 jobs over the last two months with the stroke of a pen. Figures initially released showed the United States created 254,000 jobs in September, but they have just been revised down by 31,000 to 223,000. At the same time, the August report goes from 159,000 to 78,000. Basically it’s the stadium audience that organizes the Superbowl which has just disappeared.

But everything is fine

And since we like statistics, we will also remember that of the last 11 publications of the NFP’s, 8 have been revised downwards and nearly a million jobs have been “revised” downwards over the last 24 months – jobs that we were “sold” with each publication and which – in fact – did not exist. So you will tell me that “presented like that”, it is still difficult to understand why the markets ended so strongly up on Friday evening. I admit that I didn’t understand either. However, the reason is simple:

“the BLS announced that the figures had been skewed by the Boeing strike and by the two successive hurricanes which hit the Eastern United States. They also specified that they had all the difficulty in the world to get the answers to their surveys because the victims of Florida had difficulty responding because as crazy as it may seem, the guys had other things to do. just report to the BLS”

To put it simply and summarize it, the employment figures were rotten because the people who were hit by winds of over 200 kilometers per hour and who lost their homes and their cars did not have filled out the papers correctly, but rest assured, things will be much better next month when they hire a mountain of people to clean the streets. It is therefore quite simply the hope of seeing a catch-up in terms of employment which has allowed the world stock markets to properly digest these filthy figures. And no one talks about downward revisions, because that looks bad. And we also don’t take into account the fact that within the figures, if we dig a little deeper into the private sector, we learn that the American economy LOST 28,000 private sector jobs in October, the first net loss since December 2020. And if we look at the three-month average, we see that 67,000 jobs are created on average every month, the lowest level since COVID. This figure is significantly lower than the average we had BEFORE the pandemic, which was an average of 150,000. To top it all off, over 12 months there has been a drop of 1.5 million jobs in the private sector. 1.5 million layoffs. This kind of figure has never been seen outside of a recession.

But we don’t care because if Trump is elected, he will solve the problem and if Kamala is elected, she will also solve the problem. As she has been doing so well for 4 years already with her bedridden President. So everything is going very well, as we can see. There is absolutely no reason to ask questions.

Today’s news, Asia and oil

This morning Japan is closed and Hong Kong is doing nothing while China is up 0.3%. It must be said that the standing committee of the Chinese National People’s Congress begins a four-day meeting on Monday, during which it is widely expected that we will have more information on the current stimulus. Oil is at $70.70 while waiting to know whether Iran will retaliate or not and gold is at $2,748, while Bitcoin is testing $69,000. As for the news of the day, we note that everyone has agreed not to publish anything (or almost nothing) while waiting for Tuesday’s election. There is virtually no economic news worth quoting. The only one that has the world of finance talking a little is Berkshire Hathaway, which has published its quarterly figures and which announces that its cash pile is still a little higher. Warren Buffet put 325 billion in cash and continued to reduce his investments a little more. No one understands what he is doing but we can perhaps tell ourselves that he is afraid and that he is reducing his exposure… The future will tell us.

As for the figures of the day today there is nothing consistent and for the publications of the quarter, there will be Marriott, Wynn Resort, Palantir and NXP Semiconductors. And with that, it remains for me to wish you an excellent start to the election week and we will meet again tomorrow at the same time to talk about it a little more… a lot, passionately, madly.

See you tomorrow and very good coffee everyone!

Thomas Veillet

Investir.ch

“Know what you own, and know why you own it”

Peter Lynch